Congressional Republicans say they are pressing forward after the Senate passed its $1.4 trillion tax cut bill late last week and that its differences with the House version shouldn’t create major roadblocks in the process as they look to send a bill to President Trump’s desk before year’s end.

The House adjusted its schedule this week so members can vote Monday to formally take the issue to a bicameral conference committee, where a small group of members will hammer out differences between the two versions and produce a final product that can pass in both chambers.

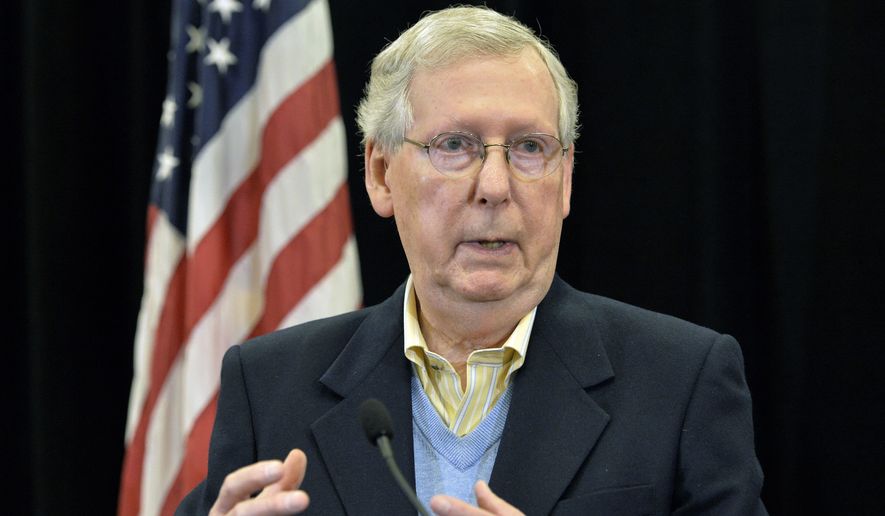

“We’ll be able to get to an agreement in the conference — I’m very optimistic about it,” Senate Majority Leader Mitch McConnell, Kentucky Republican, said Sunday on ABC’s “This Week.” “We think this will make a big difference in getting our economy moving again and providing jobs and opportunity for the American people.”

Sen. John Barrasso, Wyoming Republican, said on “Fox News Sunday” that the House and Senate versions aren’t far apart.

“Fundamentally, for the American public, we double — double — the child tax credits. We lower the rates,” Mr. Barrasso said. “And in terms of investing in an America and an America-first economy, we lower tax rates for Main Street businesses all across the country, as well as corporations, to make us much more competitive internationally.”

Senate Republicans passed their $1.4 trillion tax-cut package early Saturday, after Mr. McConnell and other Republican leaders wooed some wary members by agreeing to add items such as additional benefits for small businesses and a partial restoration of a property tax deduction that had been on the chopping block.

To pay for those changes, Republican leaders had to scale down their plans to cut the alternative minimum tax for corporations and individuals.

The AMT is a parallel tax system created in 1969 to target the wealthiest. Republicans billed a repeal as a prime example of how their plan would simplify the tax code.

The revised legislation also would increase the rates at which foreign earnings parked offshore would be taxed to more closely mirror the House’s plan. That move generated close to $100 billion — about the cost of the change to expand the deduction for smaller “pass-through” companies that file their taxes as individuals.

The Senate plan passed on a 51-49 vote. Vice President Mike Pence took the presiding officer’s chair to gavel the vote closed just before 2 a.m. Saturday.

Sen. Bob Corker of Tennessee was the lone Republican to vote against the measure, citing concerns about its effect on federal deficits and the debt.

The House and Senate plans both bring down the corporate tax rate from 35 percent to 20 percent and cut income tax rates for most individuals while weeding out various exemptions and deductions.

The bills differ on some major points, including the Senate’s repeal of Obamacare’s individual mandate.

Republican senators said in recent days that the House is unlikely to simply accept the Senate’s version. House Speaker Paul D. Ryan, Wisconsin Republican, has said repeatedly that the next step in the process is a conference committee.

But Sen. Angus S. King Jr., a Maine independent who caucuses with the Democrats, said Sunday that he thinks there is only a 50/50 chance that the bill goes to a conference.

“Because I don’t think that either side, either the House or Senate, wants to bring this back to the floor,” Mr. King said on CBS’ “Face the Nation.” “The House just may take the Senate bill and send it to the president. So what happens now is we’ve now made a 30-year decision.”

Smaller goodies also were written into the Senate bill, including one provision to carve Hillsdale College out of the new excise tax on school endowments. Hillsdale refuses government aid, and Republicans said it shouldn’t have to pay the tax.

But a handful of Republicans joined Democrats to kill the carve-out in a 52-48 vote.

It was a rare victory for Democrats, whose amendments were shot down repeatedly by a mostly unified Republican Party.

Republican leaders were making changes to the bill up to the very last moment. Infuriated Democrats said nobody knew what they were even voting on.

Sen. Mark R. Warner, Virginia Democrat, said Friday was his “single worst day” as a senator.

“This was ‘swamp 101,’ the process on Friday night, where the bill was being hand-drafted, lots of provisions were being included for special interests,” Mr. Warner said Sunday on CNN’s “State of the Union.”

Democrats will have a chance to dig through the details as the Senate plan gets reconciled with the House version, which passed in November.

Mr. McConnell said Democrats attended “tons” of hearings and had opportunities to offer amendments in committee and on the floor.

“They decided it was important to them politically to oppose this tax measure and take that to the American people,” Mr. McConnell said.

“And we’re prepared to do that because we think this country has been underperforming and we believe this will get the country performing better, providing jobs and opportunity for the vast number of people who’ve been displaced during the Obama years,” he said.

Democrats said Republicans are overly optimistic that economic growth associated with the package will more than make up for the initial $1.4 trillion price tag.

But Mr. McConnell said many economists think otherwise.

“There are a whole lot of economists who think that it will pay for itself,” he said. “The economy would only have to grow four-tenths of 1 percent over the next 10 years to fill this gap. … That’s not a dramatic improvement.

“We think [you’re] going to get a lot more growth than that,” he said. “So I’m confident this is not only revenue-neutral for the government, but actually is very likely to be a revenue producer for the government.”

• David Sherfinski can be reached at dsherfinski@washingtontimes.com.

Please read our comment policy before commenting.